Buying collectible pennies looks simple until prices start to vary wildly for coins that appear similar. One listing shows a wheat cent for $5. Another asks $500 for the same year. The difference is rarely luck. It comes down to condition, verification, and real market demand.

The penny market is crowded with hype. Online platforms amplify it. Words like rare, scarce, or estate find appear everywhere, often attached to coins that trade for a few dollars in established price guides. New buyers pay the premium. Experienced collectors wait and know what the most valuable pennies really like.

A collectible penny earns its price through evidence, not stories. The core value drivers are consistent across decades.

Key factors that matter:

- Confirmed rarity, supported by mintage or survival data

- Condition, especially original surfaces and color

- Recognized varieties or errors, not damage

- Certification, which protects liquidity

Remove one of these, and the price drops fast.

Many sellers lean heavily on dates without context. A common example is the 1941 Lincoln cent. It is old, but not scarce.

Typical reality:

- Circulated examples trade for $1–3

- High mintages across multiple mints

- Little demand outside high grades

Yet listings often price them at $15–20 raw, framed as rare finds. Such tricks come out easily via a quick check through the coin value checker app. This is not collecting. It is marketing.

True keys behave differently. The 1909-S VDB illustrates the gap. Low mintage, immediate demand, and strong certification history keep prices high across all grades. An MS-65 Red example pushes well into five figures. Even a worn coin holds four-figure value.

Raw coins are not automatically bad, but they carry risk. Cleaning, recoloring, and light damage destroy value, even if the date is desirable.

Certification solves several problems at once:

- Confirms authenticity

- Locks in grade

- Protects resale value

In many cases, a slabbed coin sells for 20–50% more than a raw equivalent. That premium reflects confidence, not hype.

Collectors who avoid losses learn to spot patterns.

Watch for:

- Shiny surfaces on older pennies labeled as “uncirculated”

- Rare error claims without close-up diagnostics

- Prices far above recent auction results

- A free coin value app shows significantly lower predictions

- Sellers avoiding certification references

If the description replaces data with emotion, walk away.

| Scenario | Asking Price | Market Reality |

| Raw “rare” wheat cent | $20 | $1–3 |

| Cleaned early Lincoln | $500 | $100 in original AU |

| Unverified doubled die | $1,000 | $1,000+ only if certified |

Understanding this foundation prevents most beginner mistakes. Once hype is stripped away, buying collectible pennies becomes a process of comparison, verification, and patience.

Once hype is filtered out, buying smart comes down to a short list of checks. These steps protect budgets and separate real opportunities from expensive mistakes. Experienced collectors run them automatically. New buyers should slow down and do the same.

Certain pennies demand basic physical verification. Skipping this step invites disappointment.

Key examples:

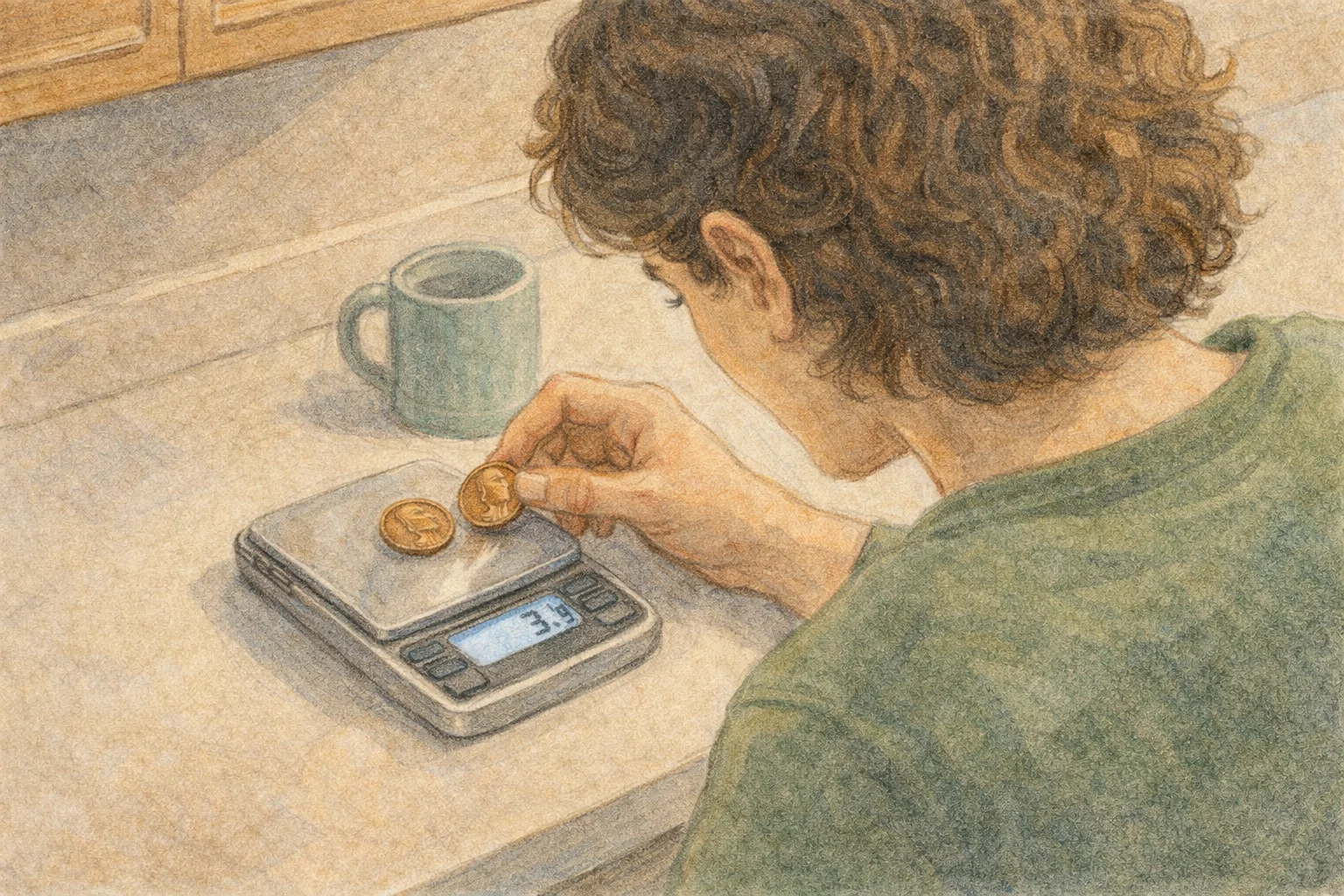

- 1943 bronze cent: should weigh about 3.11 grams and be non-magnetic

- Post-1982 cents: zinc cores suffer from corrosion; surface bubbles reduce value sharply

- Silver or wrong-planchet claims: require precise weight and edge inspection

A scale and magnet solve many questions in seconds.

Many “errors” are just abuse. True varieties follow repeatable patterns.

Focus on:

- Hub doubling, not machine doubling

- Consistent die markers listed in references

- Raised elements, not scratches or flattening

For instance, a genuine 1955 Doubled Die Obverse shows thick, rounded doubling across multiple letters. Flat, shelf-like doubling points to mechanical issues and carries little value.

Third-party grading by PCGS or NGC does more than assign a number. It validates the coin’s story.

Benefits include:

- Authentication of varieties and errors

- Protection against cleaning disputes

- Easier resale and price comparison

In many cases, certification converts uncertainty into liquidity. That is why certified coins consistently outperform raw listings in auctions.

Price guides help, but auctions tell the truth. Always compare dealer asks to realized prices from major venues.

Use auction results to check:

- Same date, mint, and grade

- Similar color designation (RD, RB, BN)

- Recent sales, not decade-old records

If a coin sits well above recent results, it needs a strong justification. Most do not have one.

| Pitfall | Typical Ask | Smarter Alternative |

| Raw “rare” date | $20–50 | Slabbed MS common for $50 |

| Cleaned early Lincoln | $500 | Original AU slab at $100 |

| Fake DDO | $1,000 | Certified example only |

| Bulk “error lot” | $10 each | One verified error at $300 |

Not all modern hype is wrong. Some varieties justify attention.

Examples with strong backing:

- 1970-S Large Date DDO, with documented auction records

- 1972 Philadelphia DDO, visible and widely collected

- High-grade common dates, where condition rarity drives demand

These coins succeed because data supports them, not because listings say “rare.”

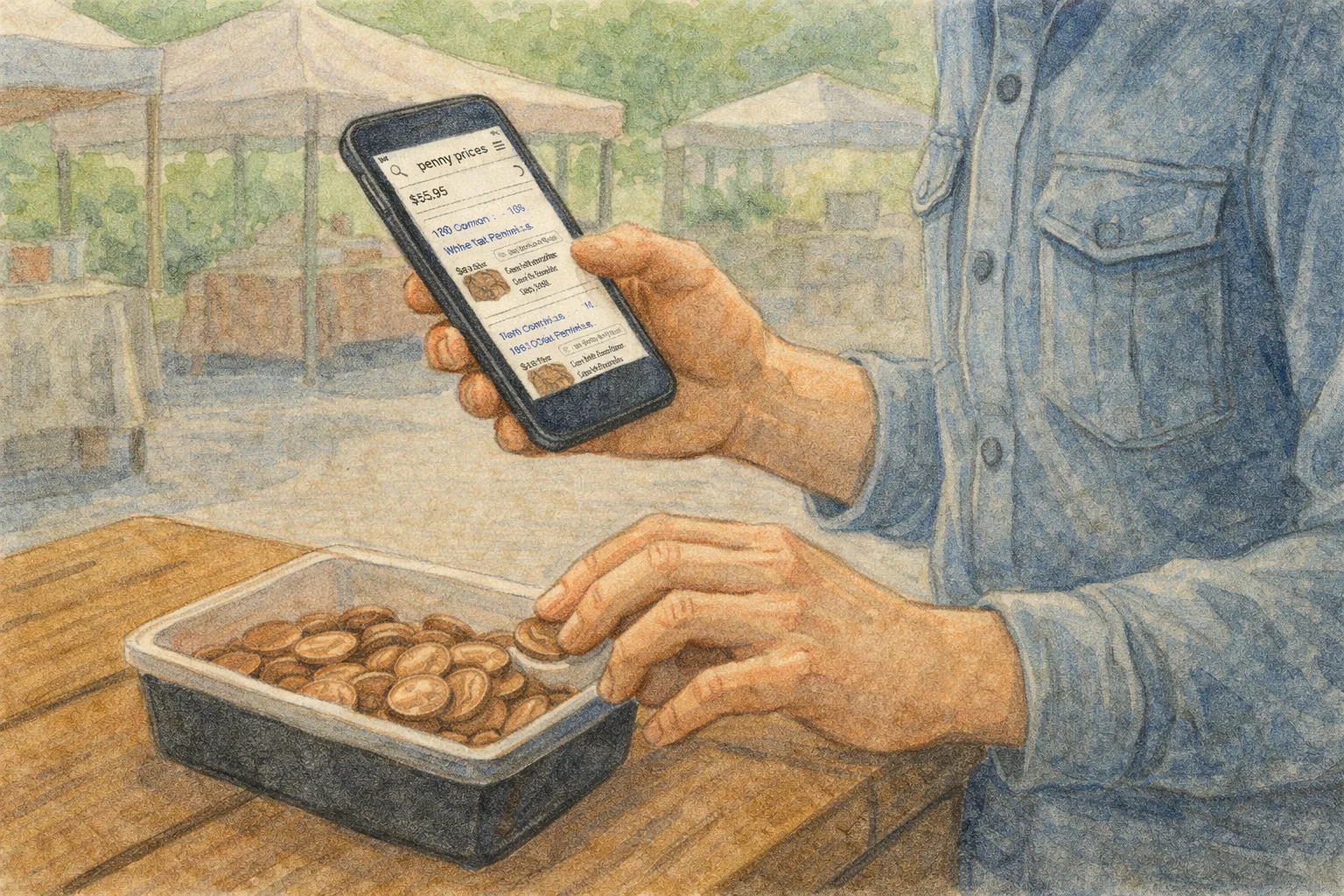

Some collectors photograph suspects at shows or while sorting rolls, then cross-check specs like year, composition, diameter, weight, and typical price ranges using tools such as the Coin ID Scanner app. Photo-based checks help dismiss overpriced listings quickly before time or money is wasted. With verification habits in place, buying collectible pennies becomes less about impulse and more about timing.

After checks and verification, the final variable is where you buy. The same penny can sell for wildly different prices depending on venue, timing, and presentation. Smart sourcing often matters more than sharp negotiating.

Reliable pricing follows transparency. Coins with documented histories trade closer to real value.

Preferred sources include:

- Major auctions (Heritage, Stack’s Bowers) for price discovery

- ANA-member dealers with return policies

- Certified inventory at coin shows, where comparison is easy

These venues expose coins to informed buyers. Prices reflect demand, not storytelling.

Raw pennies still have a place, but only under controlled conditions.

Good use cases:

- Roll hunting and bulk sorting

- Estate lots with minimal pre-screening

- Common dates purchased for grading practice

Raw purchases work best when the downside is small and the learning value is high. They do not belong in four-figure decisions.

Many buyers overpay because they rush. The penny market rewards restraint.

Practical habits:

- Track Greysheet or recent auction comps for several weeks

- Wait for repeat listings to soften

- Ignore countdown pressure in online sales

Collectors who wait often buy 20–30% below guide levels simply by letting inflated listings expire.

Keeping records prevents repeat mistakes. Notes on grade, price paid, and comps clarify future decisions.

Some collectors use tools like the Coin ID Scanner app to catalog purchases, store photos, and compare standard specifications and market ranges while building collections. Digital tracking simplifies reviews and flags upgrades when better examples appear.

Most collectible pennies advertised online are overpriced. A smaller group is genuinely valuable. The difference is not subtle once the right questions are asked.

Truly valuable pennies show:

- Verified rarity or condition scarcity

- Certification or clear diagnostics

- Alignment with recent auction results

Overpriced coins rely on:

- Emotional language

- Unverified claims

- Surface shine instead of originality

Buying collectible pennies is not about chasing legends. It is about reducing uncertainty. When verification replaces excitement, budgets stretch further and collections improve faster.

The goal is not to avoid spending money. It is to spend it where value holds after the purchase ends.